Describe how total job benefits and total employee compensation differ – The distinction between total job benefits and total employee compensation is a crucial aspect of human resource management. Understanding the components, similarities, and differences between these two concepts is essential for businesses seeking to attract and retain top talent. This article will delve into the intricacies of total job benefits and total employee compensation, providing a comprehensive overview of their impact on employee satisfaction, productivity, and overall business performance.

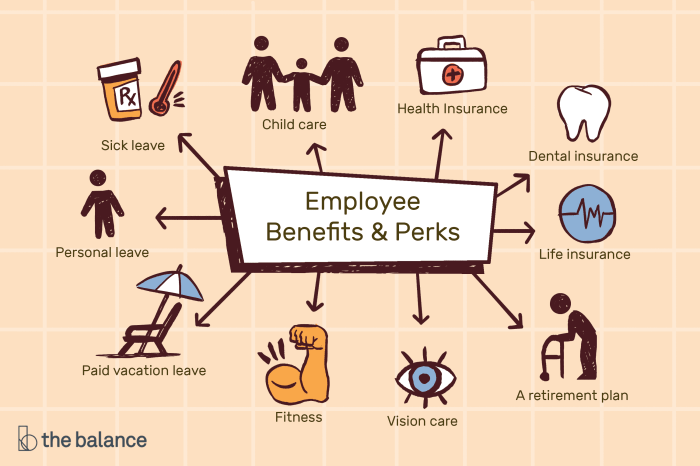

Total Job Benefits

Total job benefits are the non-wage compensation provided by an employer to its employees. These benefits can include health insurance, dental insurance, vision insurance, retirement plans, paid time off, and other perks.

Total job benefits are important for employee satisfaction and retention. Employees who feel that they are well-compensated are more likely to be happy with their jobs and stay with their employers. In addition, total job benefits can help to attract new employees.

Components of Total Job Benefits

- Health insurance

- Dental insurance

- Vision insurance

- Retirement plans

- Paid time off

- Other perks (e.g., gym memberships, discounts on products or services)

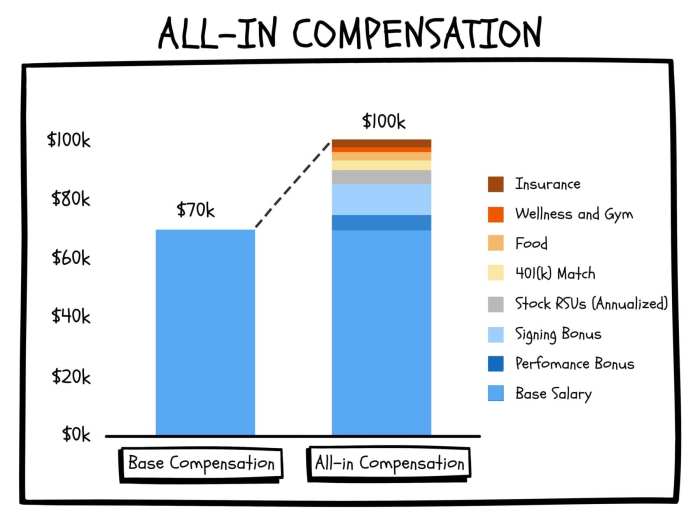

Total Employee Compensation: Describe How Total Job Benefits And Total Employee Compensation Differ

Total employee compensation is the total amount of money that an employee earns from their employer. This includes wages, salaries, bonuses, commissions, and other forms of compensation.

Total employee compensation is important for employee motivation and productivity. Employees who feel that they are fairly compensated are more likely to be motivated to work hard and produce high-quality work.

Components of Total Employee Compensation, Describe how total job benefits and total employee compensation differ

| Type of Compensation | Tax Implications |

|---|---|

| Wages | Taxable |

| Salaries | Taxable |

| Bonuses | Taxable |

| Commissions | Taxable |

| Other forms of compensation (e.g., stock options, profit sharing) | Tax implications vary |

Factors that Influence Total Employee Compensation

- Job title

- Experience

- Education

- Location

- Industry

- Company size

Differences between Total Job Benefits and Total Employee Compensation

The key difference between total job benefits and total employee compensation is that total job benefits are non-wage compensation, while total employee compensation includes both wage and non-wage compensation.

Another difference is that total job benefits are typically paid for by the employer, while total employee compensation can be paid for by either the employer or the employee.

Similarities and Differences between Total Job Benefits and Total Employee Compensation

| Total Job Benefits | Total Employee Compensation | |

|---|---|---|

| Definition | Non-wage compensation provided by an employer to its employees | Total amount of money that an employee earns from their employer |

| Components | Health insurance, dental insurance, vision insurance, retirement plans, paid time off, other perks | Wages, salaries, bonuses, commissions, other forms of compensation |

| Tax implications | Varies depending on the benefit | Taxable |

| Who pays for it | Typically paid for by the employer | Can be paid for by either the employer or the employee |

Real-World Examples

Here are some real-world examples of total job benefits and total employee compensation:

- A company that provides its employees with health insurance, dental insurance, vision insurance, a retirement plan, and 10 days of paid time off is providing total job benefits worth approximately $15,000 per year.

- An employee who earns a salary of $50,000 per year, receives a bonus of $5,000 per year, and has a company-paid retirement plan worth $2,000 per year has total employee compensation of $57,000 per year.

Impact of Total Job Benefits and Total Employee Compensation on Business

Total job benefits and total employee compensation can have a significant impact on business.

Employee Morale and Productivity

Employees who feel that they are well-compensated are more likely to be happy with their jobs and stay with their employers. This can lead to increased employee morale and productivity.

Financial Implications

Providing competitive benefits and compensation packages can be expensive for businesses. However, the cost of providing these benefits can be offset by the increased employee morale and productivity that they generate.

Case Studies

There are many case studies that demonstrate the positive impact of investing in employee benefits and compensation. For example, a study by the Society for Human Resource Management found that companies that offer comprehensive benefits packages have lower employee turnover rates and higher employee satisfaction ratings.

Questions and Answers

What is the difference between total job benefits and total employee compensation?

Total job benefits are non-cash perks and allowances provided by an employer to enhance employee well-being, while total employee compensation encompasses both monetary and non-monetary rewards, including salary, bonuses, and benefits.

Why are total job benefits important?

Total job benefits contribute to employee satisfaction, motivation, and retention by providing a sense of security, recognition, and work-life balance.

How do factors influence total employee compensation?

Factors influencing total employee compensation include industry, job level, experience, performance, and market demand.