The security market line intercepts the vertical axis at the: – The security market line (SML) intercepts the vertical axis at the risk-free rate, which is the expected return on an investment with zero risk. This point represents the minimum expected return that investors require for taking on any risk.

The SML is a graphical representation of the relationship between the expected return and risk of an asset. It is a straight line that slopes upward, indicating that investors expect to earn a higher return for taking on more risk.

1. The Security Market Line

Intercepts and Meaning

The security market line (SML) is a graphical representation of the relationship between the expected return and risk of an asset. It is a straight line that slopes upward, indicating that assets with higher risk are expected to have higher returns.

The SML intercepts the vertical axis at the risk-free rate, which is the return on an asset with no risk.

The SML can be represented mathematically as follows:

E(r) = rf+ β

- (r m

- r f)

where:

- E(r) is the expected return on the asset

- r fis the risk-free rate

- β is the asset’s beta, which measures its systematic risk

- r mis the expected return on the market portfolio

2. Relationship between Risk and Return on the SML: The Security Market Line Intercepts The Vertical Axis At The:

The SML shows that there is a positive relationship between the expected return and risk of an asset. This is because investors require a higher return to compensate them for taking on more risk. The slope of the SML, which is equal to the market risk premium, measures the amount of additional return that investors require for each unit of additional risk.

Assets with different risk profiles are positioned on the SML accordingly. For example, assets with high betas (i.e., high systematic risk) will be positioned higher on the SML than assets with low betas (i.e., low systematic risk).

3. Applications of the SML in Investment Analysis

The SML can be used in a variety of investment analysis applications. For example, it can be used to:

- Evaluate the performance of individual stocks or portfolios

- Determine the cost of equity capital

- Make investment decisions

For example, if an investor is considering investing in a stock with a beta of 1.2 and the market risk premium is 5%, the SML would indicate that the expected return on the stock is 7% (r f+ β – (r m– r f) = 2% + 1.2 – 5% = 7%).

4. Limitations and Assumptions of the SML

The SML is based on a number of assumptions, including the efficient market hypothesis. This assumption states that all available information is reflected in the prices of assets, so that it is impossible to consistently beat the market. Other assumptions include:

- Investors are rational and risk-averse

- The market is in equilibrium

- There are no transaction costs or taxes

In reality, these assumptions may not always hold true. This can lead to deviations from the SML. For example, if investors are overconfident, they may be willing to pay more for assets than they are worth, leading to a higher expected return than the SML would predict.

Essential FAQs

What is the security market line?

The security market line (SML) is a graphical representation of the relationship between the expected return and risk of an asset.

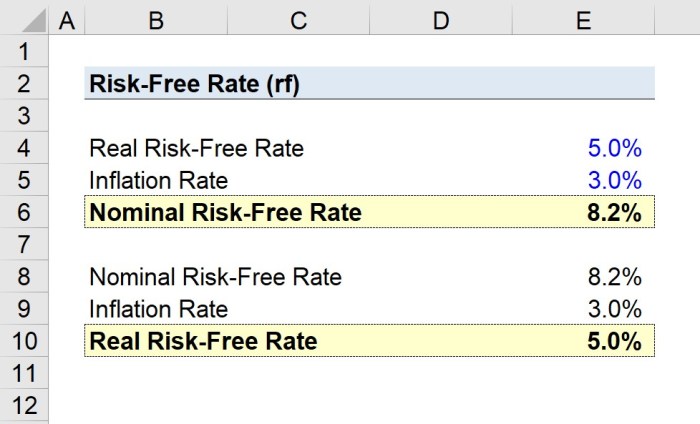

What is the risk-free rate?

The risk-free rate is the expected return on an investment with zero risk.

What is the relationship between the SML and the risk-free rate?

The SML intercepts the vertical axis at the risk-free rate.