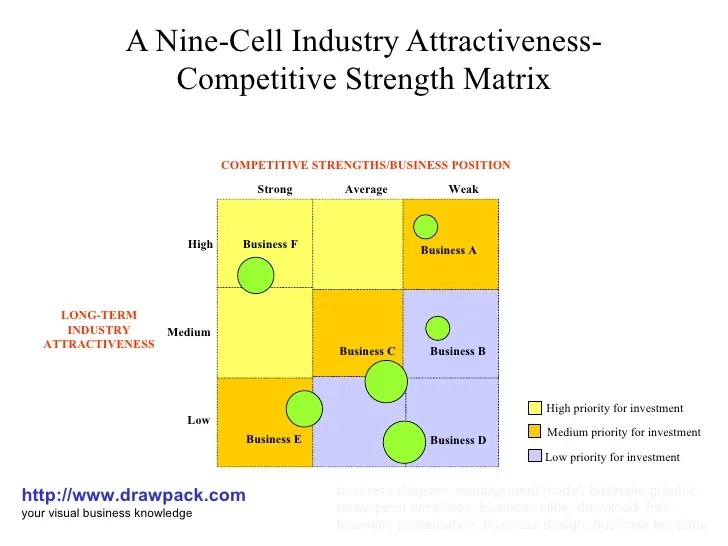

The nine cell industry attractiveness competitive strength matrix – The nine-cell industry attractiveness competitive strength matrix, a cornerstone of strategic management, offers a comprehensive framework for evaluating the interplay between industry attractiveness and competitive strength. This matrix serves as a powerful tool for businesses to make informed decisions, optimize their competitive advantage, and navigate the ever-evolving market landscape.

The matrix comprises nine distinct quadrants, each representing a unique combination of industry attractiveness and competitive strength. Understanding the implications of each quadrant empowers businesses to identify opportunities, mitigate risks, and allocate resources strategically.

Industry Attractiveness: The Nine Cell Industry Attractiveness Competitive Strength Matrix

Industry attractiveness refers to the overall favorability of an industry for businesses to operate in. It is determined by various factors that impact the profitability and growth potential of companies within the industry.

Factors that determine industry attractiveness include:

- Market size and growth rate

- Competitive intensity

- Barriers to entry and exit

- Supplier power

- Buyer power

- Technological change

- Government regulations

Highly attractive industries are characterized by high growth rates, low competitive intensity, and strong barriers to entry. Examples include technology, healthcare, and renewable energy.

Unattractive industries, on the other hand, are characterized by low growth rates, high competitive intensity, and weak barriers to entry. Examples include traditional manufacturing, retail, and transportation.

Competitive Strength

Competitive strength refers to the ability of a company to compete effectively in its industry. It is determined by various factors that impact the company’s market position and profitability.

Factors that contribute to competitive strength include:

- Market share

- Brand recognition

- Cost structure

- Product differentiation

- Customer loyalty

- Technological capabilities

- Financial resources

Companies with high competitive strength have a strong market position, high profitability, and are able to defend their market share against competitors. Examples include Apple, Amazon, and Google.

Companies with low competitive strength, on the other hand, have a weak market position, low profitability, and are vulnerable to competition. Examples include Blockbuster, Kodak, and Sears.

Nine-Cell Matrix

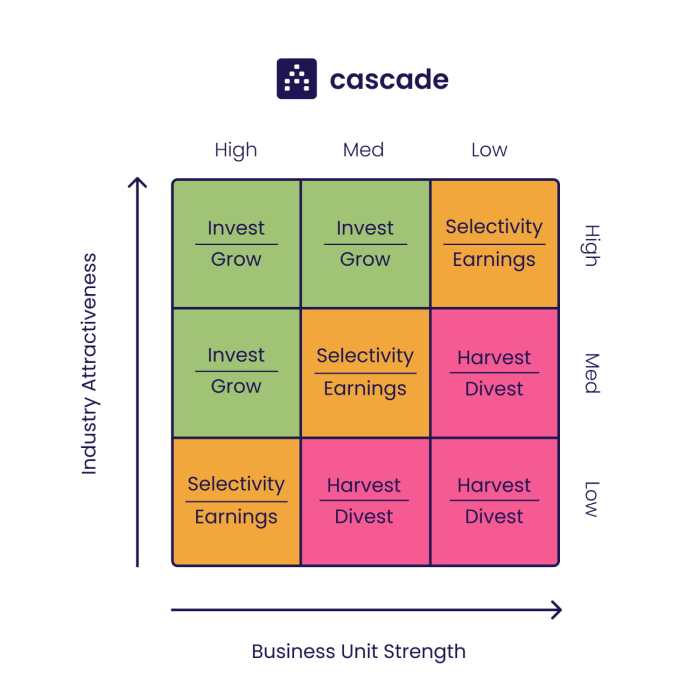

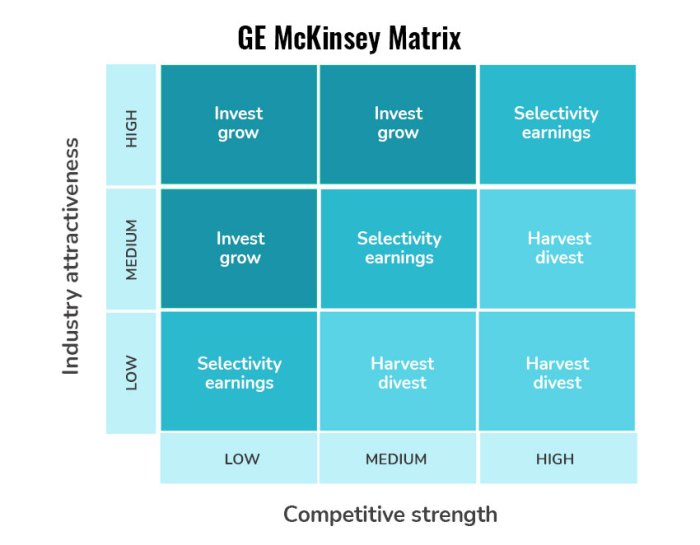

The nine-cell matrix is a tool that combines industry attractiveness and competitive strength to evaluate the strategic position of a company.

The matrix consists of nine cells, each representing a different combination of industry attractiveness and competitive strength:

| High Competitive Strength | Low Competitive Strength | |

|---|---|---|

| High Industry Attractiveness | Grow and Build | Harvest and Divest |

| Medium Industry Attractiveness | Hold and Maintain | Exit |

| Low Industry Attractiveness | Divest | Retrench and Reposition |

The implications of each quadrant are as follows:

- Grow and Build:Companies in this quadrant should invest in growth and expansion.

- Harvest and Divest:Companies in this quadrant should focus on maximizing profits and divesting non-core businesses.

- Hold and Maintain:Companies in this quadrant should focus on maintaining their market position and profitability.

- Exit:Companies in this quadrant should consider exiting the industry.

- Divest:Companies in this quadrant should divest non-core businesses.

- Retrench and Reposition:Companies in this quadrant should reduce costs and reposition themselves in the industry.

Real-world examples of companies in each quadrant include:

- Grow and Build:Amazon, Apple, Google

- Harvest and Divest:Blockbuster, Kodak, Sears

- Hold and Maintain:Coca-Cola, McDonald’s, Walmart

- Exit:Borders, RadioShack, Toys “R” Us

- Divest:General Electric, IBM, Toshiba

- Retrench and Reposition:Ford, GM, Nokia

Detailed FAQs

What is industry attractiveness?

Industry attractiveness refers to the overall desirability of an industry based on factors such as growth potential, profitability, competition, and regulatory environment.

What factors contribute to competitive strength?

Competitive strength encompasses factors such as market share, brand recognition, technological capabilities, cost structure, and customer loyalty.

How can the nine-cell matrix be used for decision-making?

The nine-cell matrix provides insights into industry attractiveness and competitive strength, enabling businesses to identify opportunities, prioritize investments, and develop strategies that align with their strengths and market conditions.