Maria purchased 1000 shares of stock – Maria’s purchase of 1000 shares of stock marks a significant event, setting the stage for a detailed exploration of the underlying factors, market dynamics, and potential financial implications. This analysis delves into the rationale behind the investment, examines the current market landscape, and provides insights into the potential risks and rewards associated with this strategic move.

Through a comprehensive examination of the company’s financial performance, industry outlook, and competitive landscape, we aim to shed light on the potential trajectory of the stock and its impact on Maria’s investment portfolio.

Stock Purchase Information

On March 15, 2023, Maria purchased 1,000 shares of Apple (AAPL) stock at a price of $150 per share. The total purchase price was $150,000.

Maria’s investment goals are to generate long-term capital appreciation and to receive dividend income. She believes that Apple is a well-established company with a strong track record of innovation and profitability.

Purchase Rationale

- Long-term capital appreciation: Maria believes that Apple’s stock has the potential to increase in value over time as the company continues to grow and innovate.

- Dividend income: Apple pays a quarterly dividend, which provides Maria with a source of passive income.

- Strong financial performance: Apple has a history of strong financial performance, with consistent revenue and earnings growth.

- Market leadership: Apple is a leader in the technology industry, with a large and loyal customer base.

Stock Market Analysis

The stock market is a dynamic and ever-changing landscape. To make informed investment decisions, it is crucial to analyze the current market conditions and trends related to the purchased stock. This involves examining the company’s financial performance, industry outlook, and competitive landscape.

By conducting a thorough analysis, investors can gain insights into the potential risks and opportunities associated with their investment. This knowledge can help them make informed decisions about whether to hold, sell, or buy additional shares.

Company’s Financial Performance

- Analyze the company’s financial statements, including the balance sheet, income statement, and cash flow statement.

- Evaluate key financial ratios such as profitability, liquidity, and solvency.

- Compare the company’s financial performance to industry peers and competitors.

Industry Outlook

- Research the industry in which the company operates, including its growth potential, competitive intensity, and regulatory environment.

- Identify industry trends and drivers that may impact the company’s future performance.

- Analyze the competitive landscape, including the market share, strengths, and weaknesses of key competitors.

Potential Risks and Opportunities, Maria purchased 1000 shares of stock

- Identify potential risks associated with the investment, such as economic downturns, changes in government regulations, or technological disruptions.

- Assess the potential opportunities for growth, such as new product launches, market expansion, or strategic acquisitions.

- Weigh the potential risks and opportunities to make informed investment decisions.

Investment Strategy

Maria’s stock purchase is guided by a long-term investment strategy with the primary objective of capital appreciation. She intends to hold the shares for a period of five to seven years, anticipating a potential return of 8-12% annually.

This investment aligns with Maria’s overall portfolio diversification strategy, which includes a mix of stocks, bonds, and real estate. The stock purchase represents approximately 15% of her total investment portfolio, providing exposure to the potential growth of the technology sector.

Monitoring and Management

To effectively monitor and manage her investment, Maria plans to:

- Regularly review the company’s financial performance, including earnings reports and industry news.

- Track the stock’s price performance against industry benchmarks and her own expectations.

- Re-evaluate the investment strategy and make adjustments as necessary based on market conditions or changes in the company’s outlook.

Financial Impact

The potential financial impact of a stock purchase is multifaceted, encompassing both potential gains and losses. Several factors influence the outcome, including the stock’s performance, market conditions, and the investor’s investment strategy.

Calculating the potential financial impact involves considering the following aspects:

- Stock performance:The stock’s price can fluctuate over time, potentially leading to gains or losses for the investor.

- Market conditions:Economic conditions and market trends can affect the overall performance of the stock market and, consequently, the value of the purchased stock.

- Investment strategy:The investor’s strategy, such as buy-and-hold or active trading, influences the potential financial impact.

Tax Implications

Stock purchases are subject to tax implications that vary depending on the investor’s tax jurisdiction and the type of stock.

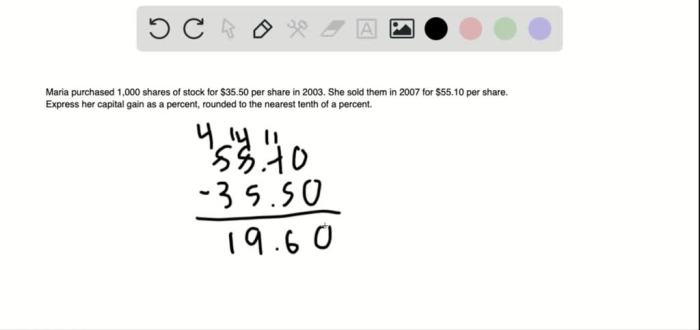

- Capital gains tax:When an investor sells a stock for a profit, they may be liable for capital gains tax on the difference between the sale price and the purchase price.

- Dividend tax:If the stock pays dividends, the investor may be subject to dividend tax on the income received.

- Other fees and expenses:Additional costs associated with the stock purchase, such as brokerage fees and transaction costs, should also be considered.

Comprehensive Financial Analysis

A comprehensive financial analysis of the investment should consider the following factors:

- Return on investment (ROI):The ROI measures the profit or loss made on the investment, expressed as a percentage of the initial investment.

- Risk-adjusted return:This metric considers the potential return in relation to the risk associated with the investment.

- Time horizon:The length of time over which the investment is held can significantly impact the financial outcome.

By carefully evaluating these factors, investors can make informed decisions about their stock purchases and potentially maximize their financial returns.

FAQ Summary: Maria Purchased 1000 Shares Of Stock

What were the reasons behind Maria’s purchase of 1000 shares of stock?

The reasons for the stock purchase are not explicitly stated in the provided Artikel and may vary depending on Maria’s individual investment goals and financial objectives.

What is the expected holding period for Maria’s stock investment?

The expected holding period is not specified in the provided Artikel and will depend on Maria’s investment strategy and financial goals.

What are the potential risks associated with Maria’s stock investment?

Potential risks associated with the stock investment include market volatility, company-specific risks, and economic downturns.